vol·a·til·i·ty | noun

: the quality or state of being volatile (adj | characterized by or subject to rapid or unexpected change)

Use cases:

1.

: a tendency to change quickly and unpredictably.

Example: For an example of price volatility, look at the peformance of equities in the US stock market today. Actually, maybe don’t look at the stock market today.

2.

: a tendency to erupt in violence or anger.

Example is hidden. (Hint: White Lotus Season 3 – no spoilers!)

3.

: the quality of being readily vaporizable at a fairly low temperature.

Example: the “false spring” weather in New York City.

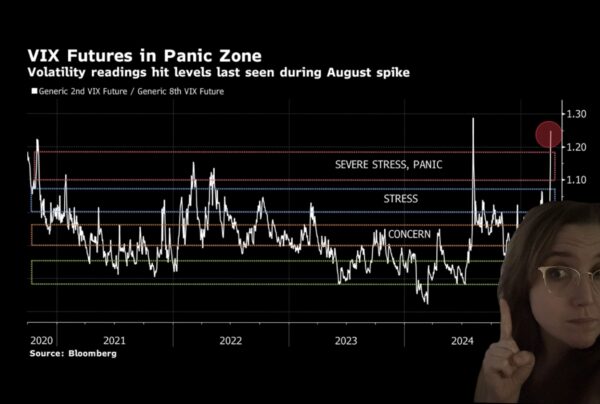

CBOE Volatility Index (VIX) | investment metric

: a common metric used to measure the expected volatility of the S&P 500. In this case, volatility refers to how quickly the markets move and more volatile stocks imply a greater degree of risk and potential losses. (Source: Investopedia)

Image: a sticker of my face layered over the chart, VIX Futures in Panic Zone: Volatility readings hit levels last seen during August spike, available on Bloomberg. My hand points toward the spike in the reading today that appears to be similar in height to the spikes from August 2024 and March 2020.

Yeah, so, uhh, anyways, if you carry any equities in your investment portfolio, you may want to keep a careful watch on the market and the tariff news cycle this week. Remember “volatility” does not necessarily mean “panic” at its core definition, but it can (and often will) lead to panic.

Here’s NY times with the latest.

Disclaimer: The information contained within this post is made for educational and entertainment purposes only. It is not to be taken as financial or investment advice. You should not construe any such information or material herein as legal, tax, investment, financial, or other advice. Consult with a licensed financial advisor before making any investment decisions. As a starting point, give the customer service line of your brokerage company a call.